As Arizona’s cannabis market matures, its two largest metro areas—Phoenix and Tucson—are showcasing distinct consumer behaviors, delivery preferences, and transportation logistics. While both cities operate under the same state regulations, how cannabis is purchased, delivered, and consumed often reflects the local lifestyle, geography, and infrastructure of each market.

Consumer Buying Patterns: Fast-Paced Phoenix vs. Laid-Back Tucson

In Phoenix, the pace is quick, and the cannabis transactions tend to reflect that. Consumers here often lean toward convenience-based purchases—favoring pre-roll multipacks, disposable vape pens, and fast-acting edibles. Many shoppers in the Valley rely on mobile apps to schedule deliveries or use express pickup at dispensaries, emphasizing efficiency.

By contrast, Tucson consumers are more inclined toward flower and concentrate-based purchases, often favoring locally cultivated strains. Tucson’s cannabis community is known for its loyalty to regionally grown products and artisanal brands. Budtenders here often build longer-term relationships with patients and adult-use consumers alike, which translates to repeat business and slower-paced, more personalized transactions.

Local Preferences: Strain Choices and Cultural Influences

The Phoenix market often gravitates toward high-THC, brand-driven products, especially those that are marketed with urban appeal. Top brands from California and other states are popular here, driven by younger buyers in urban neighborhoods and a tech-savvy crowd.

Tucson’s buying trends, however, reflect a more locally rooted culture. Strains with landrace genetics or terpene profiles that thrive in southern Arizona’s desert climate—like Durban Poison, Acapulco Gold, and Afghan Kush—tend to outperform. Local education around wellness and therapeutic use also shapes preference: Tucson dispensaries report higher interest in CBD-heavy products and ratio tinctures among medical patients.

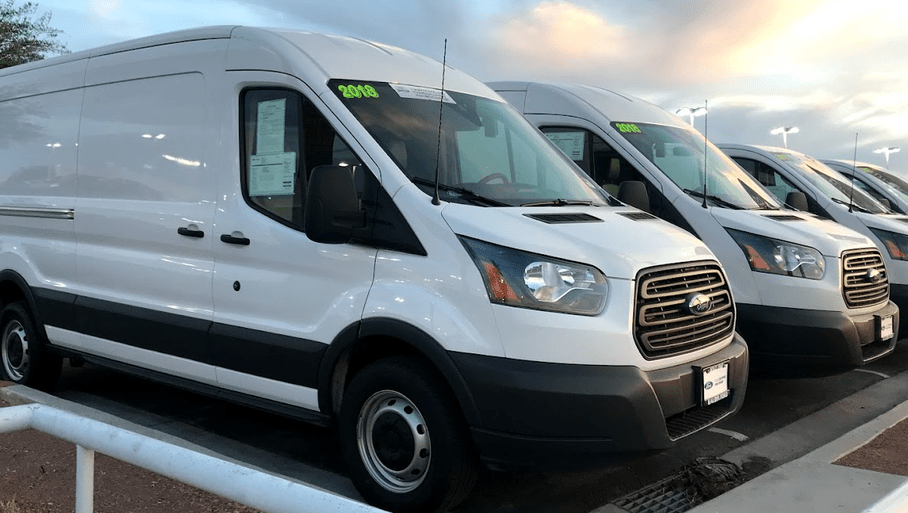

Transportation and Delivery Logistics

Phoenix’s massive sprawl and heavy freeway usage make transportation logistics more complex—but also scalable. Dispensaries often rely on optimized fleet management software, integrating delivery tracking, ID verification, and route optimization into their daily operations. With such high volume, many Phoenix dispensaries run multiple deliveries per hour, treating the city like a cannabis version of DoorDash.

Tucson’s logistics, on the other hand, are more localized and intimate. Fewer traffic bottlenecks and a tighter city grid allow for smoother delivery windows, even if volume is lower. Delivery services here often have closer customer interaction, including follow-up texts and confirmation calls. Drivers may cover wider rural zones outside city limits—particularly for medical cardholders—requiring a different strategy that balances time, distance, and patient needs.

Bridging the Gap

As the Arizona market continues to evolve, Phoenix and Tucson offer a microcosm of urban versus regional cannabis economics. While Phoenix leans into speed, branding, and scale, Tucson thrives on trust, local roots, and patient care. Delivery logistics in both cities mirror those differences, shaped by population density, consumer expectations, and the surrounding infrastructure.

Operators looking to expand into either city would do well to tailor their strategies accordingly—recognizing that while they share a state, Phoenix and Tucson are two very different beats in Arizona’s cannabis rhythm.