As federal cannabis legalization edges closer to reality, conversations around interstate commerce and regional distribution are heating up. If the U.S. lifts federal restrictions, Arizona is well-positioned to become a dominant cannabis distribution hub for the Southwest—and potentially beyond. With its mature infrastructure, streamlined licensing model, and geographic advantage, the Grand Canyon State could be the logistical backbone the cannabis industry didn’t know it needed.

The Case for Arizona as a Distribution Powerhouse

Arizona already has one of the most efficiently run cannabis programs in the country. With only 169 licensed dispensaries and a vertically integrated system, the state has built a tightly regulated, scalable industry. Unlike oversaturated states such as Oklahoma or New Mexico, Arizona’s controlled market encourages consistency in quality and supply—a critical component for long-distance cannabis logistics.

More importantly, Arizona cultivators are producing more cannabis than the state consumes. This oversupply, which has driven down wholesale prices, could become an asset if national borders open. Instead of wasting excess flower or scaling back production, Arizona growers could redirect inventory to meet demand in nearby states with newer or less developed programs.

A Perfect Fit for a Hub-and-Spoke Model

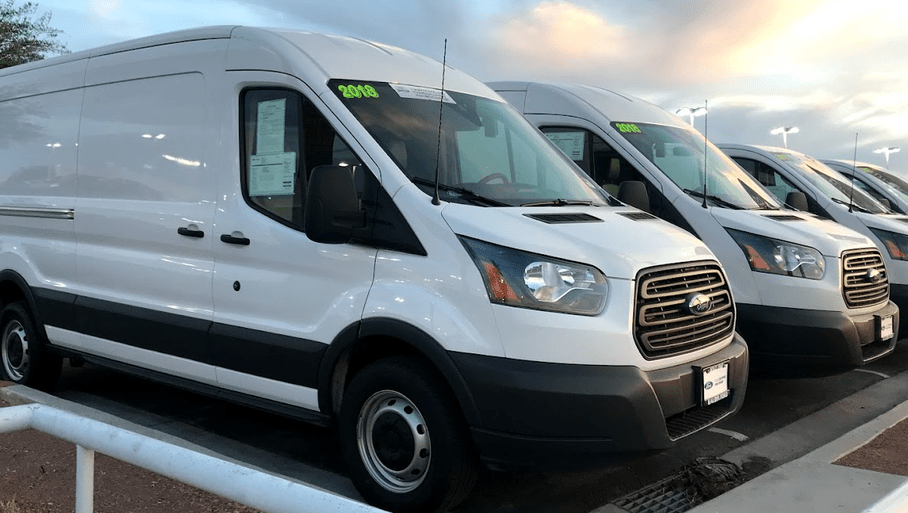

The cannabis industry is still finding its rhythm when it comes to logistics and distribution. If federal legalization permits interstate commerce, a “hub-and-spoke” model—where a central hub supplies multiple surrounding markets—could bring the kind of structure the industry has lacked.

Arizona’s central location in the Southwest makes it a natural candidate for this model. With direct highway access to California, Nevada, New Mexico, Texas, and even Colorado, Arizona could serve as the nexus point for transporting flower, concentrates, edibles, and more throughout the region. Major cities like Phoenix and Tucson already support robust warehousing and shipping infrastructure, which could be adapted to support large-scale cannabis operations.

A Climate and Workforce Built for Growth

Unlike coastal states with inconsistent growing seasons or high humidity, Arizona’s arid climate is ideal for large-scale cultivation. Many of the state’s leading producers have already invested in massive indoor and outdoor grow operations, and they’ve fine-tuned their methods over the years. A skilled, cannabis-savvy workforce and access to packaging, testing, and transport partners further reinforce Arizona’s readiness to become a regional supplier.

Additionally, Arizona’s political climate is becoming increasingly cannabis-friendly. With bipartisan support for medical and adult-use cannabis, and a track record of regulatory efficiency, the state could become a model for safe and compliant cannabis movement across state lines.

Would the Industry Embrace a Centralized Hub?

Absolutely. Much like traditional agriculture or pharmaceuticals, cannabis logistics could benefit from centralized distribution. A hub system would allow for better inventory management, streamlined compliance protocols, and more affordable bulk shipping—all of which could help lower costs and increase access for consumers nationwide.

Final Take

If and when federal legalization arrives, Arizona won’t just be a state with great flower—it could become the beating heart of a multi-state distribution network. With surplus product, smart infrastructure, and a prime location, Arizona is already looking like the Southwest’s most obvious choice for a national cannabis hub. The question isn’t if the industry would embrace a distribution model like this—it’s when.